Date Published 20 September 2010

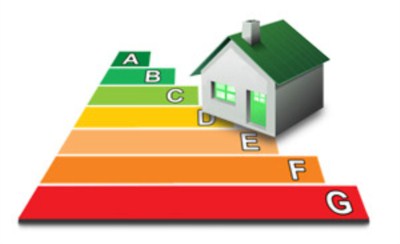

Landlords are being urged by Lesters to take full advantage of a Government initiative which helps them to improve the energy performance rating of their properties, and reduce the amount of tax they are obliged to pay in the process.

The Landlord's Energy Saving Allowance (LESA) is a tax allowance which allows landlords to claim tax relief of up to £1,500 on their tax return against the cost of buying and installing energy saving items.

It was first introduced in April 2004 to encourage landlords to improve the energy efficiency of let residential properties and to increase the level of comfort for tenants.

With the scheme due to run until the start of April 2015 landlords have plenty of opportunity to claim the allowance over the next four years.

Lesters Senior Partner, James Gesner says that uptake for the allowance has been low as landlords are simply unaware that it exists. As a result many properties still have significantly lower energy performance ratings than they could have.

James Gesner says: 'Many landlords that I speak to are simply unaware that this support is available. Not only does the LESA help landlords with the initial cost of buying and installing new products, but it helps to increase the long-term value and rental potential of the property, by passing on the cost saving benefits of reduced energy bills for tenants.'

James adds: 'It is very encouraging that the government provides support and incentives to the rented sector and we urge landlords to take full advantage of this scheme. Landlords can benefit from the saving on cavity wall insulation, loft insulation, solid wall insulation, draught proofing, hot water system insulation and floor insulation.'

Lesters suggests that landlords considering installing energy saving measures should also consult their local authority or energy supply company to establish whether grants from public funds are also available.